You have a choice to bank where overdraft fees are completely optional... And even customizable.

When you shopped around, comparing different banks, and decided which one was best for setting up a checking account, you chose the one with the benefits and services you preferred. Even after you chose your preferred bank and the perks they offered, you still had to take the goods along with the not so good but unfortunately a standard aspect of traditional banking, i.e., overdraft fees. Sometimes it's out of your control or sometimes it's kind of your fault in the case spending more than you have in your account causing your balance to dip below $0. Most times at most banks, it would cost you dearly -- $35 per transaction, no matter how big or small the amount charged. These kinds of penalty fees can be a big detriment to your finances and even incur other fees like maintenance fees if your balance ever drops below the minimum amount, not to mention the eventual negative mark on your creditworthiness. However, Capital One 360 Checking is not one of those banks with an overdraft policy that's like financial quick sand in hard times.

Capital One 360 now has four options you can you choose from in case you overdraw your 360 Checking account, or to prevent overdrafts altogether. Those options are Auto-Decline, Free Savings Transfer, Next Day Grace, and Overdraft Line of Credit:

Auto-Decline

This option is always in effect by default for all newly opened 360 Checking accounts unless you opt for another overdraft protection option. If you stick with Auto-Decline, all debit card transactions that would put your account in overdraft will be simply declined. However, pre-authorized transactions like gas station purchases may still overdraw your account, but you won't be charged any fees if that should happen

Free Savings Transfer

Unlike Auto-Decline, you have to opt in to enroll in this service and there is no cost to use it; you just have to set up a 360 Savings account or have a qualifying money market account to enroll. With this option, available funds are automatically transferred from your savings account to cover transactions that would take the available balance in your checking account below $0.00. Free Savings Transfer does come with some limitations:

- You're only allowed to link just one savings or money market account as overdraft protection, and the ownership of this account must match the ownership of the linked 360 Checking account.

- If the available balance in your savings or money market account isn't enough to cover the whole overdraft amount, no transfer of funds would occur, and the transaction will eithier be (a.) returned as unpaid and you would be charged a Non-Sufficient Funds (NSF) fee when applicable, or (b.) just have a negative balance on your account without any penalty

- Because savings and money market account transfers are limited to six (6) transfers per month, Free Savings Transfers also count with this monthly limit. If that limit is reached before the end of the month, overdraft transfers won't be processed and your transaction might be declined

Next Day Grace

If you opt for this service, Capital One would actually consider covering your overdrafted amounts and give you until the next business day to bring your balance back up. But if you fail to bring up your balance by the next day, you will be charged an overdraft fee of $35; overdrafts of $5 or less or transactions of $5 or less that overdraw your account won't be charged a fee. With this option Capital One is basically giving you the benefit of the doubt if you were to accidentally overdraw your 360 Checking account. There are two tier of Next Day Grace coverage:

- Next Day Grace STANDARD: Capital One will consider covering your check, electronic payment (ACH), and recurring debit card transactions if your available balance isn't enough to cover them

- Next Day Grace PLUS: Capital One would consider covering not only check, electronic payments, and recurring debit card transactions but also ATM withdrawals and non-recurring debit card transactions if your available checking account balance isn't enough to cover them

Overdraft Line of Credit

Enrollment in this service gives you a small unsecured revolving line of credit to cover your overdrafts, but with much, much lower fees. If you overdraw your account, Overdraft Line of Credit (OLOC) covers the difference. And instead of being charged a hefty overdraft fee, you just pay a small amount of interest on the amount borrowed for the amount of time it takes to pay it back (literally a tiny fraction of what other banks charge in fees). Here's what OLOC also entails:

- Maximum coverage amount up to $1000 (depending on credit limit you're approved for)

- You can make a minimum payment by the last day of each month

- Enrollment requires you to apply and be approved via credit check which might affect your credit score

- Like any credit card or other line of credit, you won't be able to cover overdrafts in excess of your given credit limit

NOTE: If you still prefer to use paper checks, you will incur a $9 non-sufficient fund fee for all checks that bounce, regardless of which overdraft coverage you choose including Auto-Decline.

Capital One 360 is a bank that actually gives you a leg up in managing your money, and now has better options to help keep you from falling into the black hole that is overdraft fees. Their 360 Checking accounts also offer some fairly awesome perks, too such as:

- No monthly fees and no minimum balance required to open or keep an account.

- Monthly interest earned on your money - currently 0.20% APY.

- 38,000 fee-free Allpoint® ATM Machines and 2,000 Capital One® ATM's located nationwide

- Free MasterCard® Debit Card for all purchases

- Free Online Bill Pay and Person2Person Payments

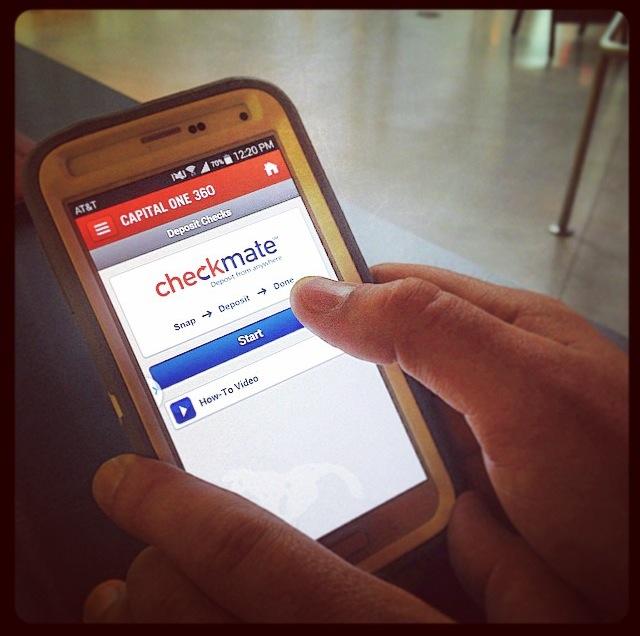

- FDIC-insured mobile check deposits with CheckMate phone app or online via computer & one free checkbook

If your want to take advantage of these 360 Checking benefits, set up your free account today!