If you're familiar with how traditional brick-and-mortar banks work, then you're probably more than familiar with the long lines, the teller pushing services on you that you're not interested in every time you're just trying to quickly cash a check, and then there's the fees... Those monthly service fees charged because your account balance has fallen below a certain amount or your not getting Direct Deposit due to being jobless, the foreign transaction fees charged if you use your debit card abroad, and those ungodly overdraft fees of $35 - for each transaction overdrawing your account. But there is an alternative, a number of independent online alternatives to the traditional banks that are vying for your business. When you get into comparing these online banks, you wonder which would be best for your needs

Capital One, however, is a well-known major brick-and-mortar bank like Wells Fargo, Bank of America, Chase, etc. that offers much of the same services mentioned for better or for worse, but this bank offers a great alternative to conventional banking. Capital One's 360 Checking option is a mobile and online banking option that charges no monthly service fees nor requires a minimum balance or any recurring deposits to keep an account with them, which like most other online banks, but there's a number of great features of 360 Checking that puts this above the other online banks.

The Benefits of Capital One 360 Checking At a Glance

It's very simple to set up a 360 Checking account. To qualify, you must be 18 or older, a U.S. citizen or permanent resident with a social security number, and have a decent credit history.Other than that Capital One 360 Checking provides you with:

- No monthly service fees and no minimum balance required to open or keep your account.

- Monthly interest earned on your account balance - currently 0.20% APY.

- Access to over 38,000 fee-free Allpoint® ATM Machines and 2,000 Capital One® ATM's located nationwide

- Free MasterCard® Debit Card with embedded microchip technology for purchases, an online security button to turn your card on or off, plus text and email alert options

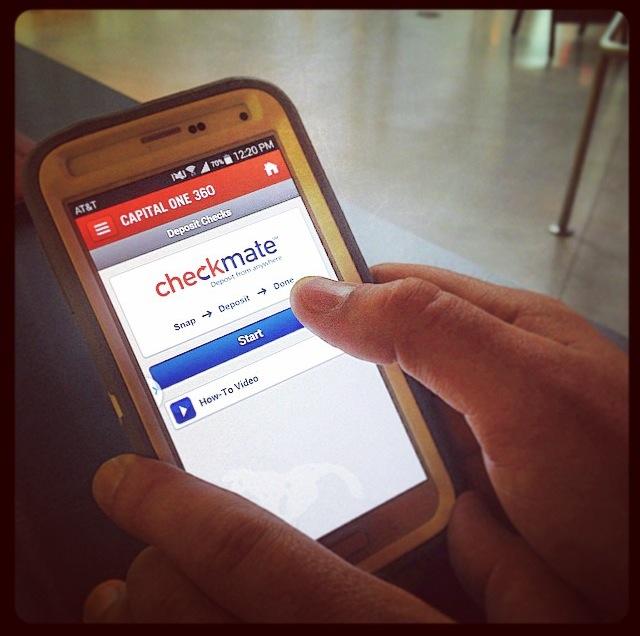

- FDIC-insured transactions including purchases, mobile check deposits with CheckMate app or via computer, external transfers, automatic bill payments, and more

- One free checkbook

Person2Person Payments

With this feature, you can easily send money to anyone with a valid bank account free of charge, similar to how PayPal works. Simply log in to your 360 Checking account, enter the recipients name, their email address and the last 4 digits of their bank account number. Then once the recipient verifies in the verification email sent to them from Capital One, the money will be transferred to them. If you send money to another Capital One customer they'll receive their funds instantly, otherwise it takes up to 2 business days for non account holders to receive money you sent to them.BillPay

Capital One 360 Checking offers this bill payment service where you can electronically send payments for utility, credit card, and other expenses for participating merchants. You can also set up eBills to receive electronic bills and keep track of bill reminders and your BillPay transaction history.Fee-Free Foreign Purchase Transactions

A great perk of 360 Checking is that you won't have to worry about any purchase fees if you travel abroad. Now that Capital One has implemented the new embedded chip technology onto their MasterCard Debit Cards, you can use your card for purchases in any foreign country for no extra charge. All you do is sign into your account online, click the "Debit Card" tab, fill out the form in the "Travel Plans" section, and enjoy your trip!Mobile Check Deposits and the CheckMate App

|

| Capital One 360' free CheckMate App |

Optional Overdraft Protection Options

Capital One has one of the most lenient overdraft policies out of all the major banks, but the absolute best thing about it is that 360 Checking does not charge any overdraft fees... That is if you opt to not add overdraft protection when you set up an account, otherwise you're just limited to spending only what's in your account balance - and any transaction made with insufficient fund in your account is automatically declined.Though if you do elect to add overdraft protection, Capital One has 2 options to choose from:

- Auto-Decline: This is the option that is already in place when you sign up for an account. Here, any transaction you make that would cause your checking account to drop below $0.00 will be automatically declined and you're only limited to spending what's in your account

- Overdraft Line of Credit: This option works as instead of being charged a flat costly overdraft fee, you only pay the small daily periodic interest (0.0315% at the current APR of 11.50%) on just the amount overdrawn up to the credit limit you're offered. You would pay this off just by making a deposit by the end of the month when the accrued interest is automatically deducted from your account (you can also pay it off earlier so you can pay less interest). For example, say you have $100 in your checking account with a $50 Overdraft Line of Credit Limit and you overdraw by spending $150 for a purchase; you'll only pay the interest for the $50 overdrawn. Then if you were to go 30 days before paying it off, only $0.48 is what you would be charged in accrued interest. This option is only processed when your account balance dips below $0.00 up to your given limit. Keep in mind that if you make or authorize any transaction(s) that would exceed your given credit limit, the transaction will be declined.

- Free Savings Transfer: This type of overdraft protection has no fees, requires no credit check of any kind but would require you to set up a free 360 Savings account. Therefore if you were to ever overdraw your 360 Checking account by any amount, funds would come directly from your 360 Savings to cover the overdrawn amount as long as you have enough in your savings balance to cover that amount.

- Next Day Grace: With this option, Capital One will actually consider covering your overdraft at their discretion, that is if you're able to bring your balance back up by the next day. This option offers two tiers of Next Day coverage, such as the Next Day Standard that covers checks, electronic payments (ACH) and recurring debit card transactions. The other option, Next Day Plus, covers checks, electronic payments, recurring debit card transactions, ATM withdrawals, and non-recurring debit card transactions that may cause you to overdraw. Which ever Next Day option you choose, you have a full day to bring your account balance back up, however if you're not able to take care of the overdrawn amount by the next day, you will be charged the standard $35 overdraft fee

|

| 360 Checking's Overdraft Line of Credit calculator. |

All of these options are completely optional and you can easily opt out of each of them at any time.

It's important to note that Capital One does do a soft credit inquiry (where your credit score isn't affected) on all applicants who apply for 360 Checking minus overdraft protection. However, if you elect to have the Overdraft Line of Credit during the application process, Capital One will do a hard pull on your credit that could affect your credit score and possibly your chances of approval for a 360 Checking account.So if you do intend on having overdraft protection, particularly the Line of Credit option, it is recommended that you apply for this option after you've been approved for an account. That way if you have anything in your credit history that may seem troublesome to most financial institutions, chances are it probably won't show up when Capital One does a soft pull of your credit and you could avoid getting declined for 360 Checking.

Refer a Friend Program

Refer a Friend Program

Last but not least, Capital One 360 has a referral program where you can refer friends, family, coworkers, or any acquaintances to sign on as new customers for a 360 Checking and/or 360 Savings account and earn $20 for each person who sets up an account.Plus Capital One 360 offers a $25 New Customer Bonus to select customers who are approved for an account, makes an initial deposit of $250 or more, and makes any combination of 3 debit card purchases or Person2Person transactions within 45 days of opening their account.

The Perfect Option If You Crave Convenience With No Hassles

Out of all the options available online for mobile banking, Capital One 360 Checking is probably the best alternative to the traditional banks in offering nothing but convenience in providing no-cost access to your own money (through their large network of fee-free ATM's nationwide), simple options to electronically deposit funds, free bank and Person2Person money transfers, BillPay, and best of all no crippling overdraft fees - basically all of these great benefits from an established, trustworthy banking institution that's still a leader in the industry.

If this sounds awesome to you, just apply and set up your 360 Checking account today by clicking the special link below to get your $25 New Customer Bonus.

SPECIAL LINK for 360 Checking with $25 Bonus: https://captl1.co/2sQU68k

SPECIAL LINK for 360 Savings with $25 Bonus: https://captl1.co/2sQU68k

<a href="http://feedshark.brainbliss.com">Feed Shark</a>